What is Investor Day?

Adam Hardej

Prev. OnePager Co-Founder

October 18th, 2021

Investor Day is a newsletter that shares OnePagers with over 700 active investors to help fundraising founders get more exposure.

We first launched Investor Day over a year ago to help founders using OnePager supercharge their fundraising process. Since then we’ve shared over 500 startups with an investor network that has grown to include over 700 active investors with representation from firms like Sequoia, Accel, and Greylock as well as angel groups like Harvard Business School Angels and AirAngels.

If you’re an active investor and want to check it out, you can apply here.

If you’re a founder looking to get more exposure, all you need to do is sign up for OnePager.

Below are answers to some of the most common questions we get about Investor Day.

Does it work?

Yes. Yes it does.

Here are some testimonials from founders who have participated in the past:

“HiHome is officially closing our pre-seed round this week (with ~1/2 of the investors coming through OnePager / were referred to us by someone who found us on OnePager -- woohoo)!”

- Tony Shu, HiHome

"Investor Day generated as many leads/first meetings in a week as I had been able to secure during the first month of the raise."

- Austin Lee, Kaya

"At first we were skeptical. Investor Day flies in the face of the traditional “warm intros only” approach to fundraising. But how can you argue with results? At least 10 reputable VCs reached out to us within a few days of the investor day. It was a huge time saver!"

- Dustin Boss, Telepath.io

Here's a deeper look at a founder experience: How Investor Day Helped HiHome Raise a Pre-Seed Round

And here’s a longer post that touches on the value from the investor perspective: How a Newsletter Led to a $6M Round

What types of investors are in the audience?

All types. From Partners at big firms to individual Angel investors.

Here's a list of some recognizable funds in the audience:

1517 Fund, Accel, Afore Capital, AirAngels, Bessemer Venture Partners, CRV, General Catalyst, Insight Partners, Lerer Hippeau, OpenView, Pear, Rarebreed Ventures, Republic, Rosecliff, Sequoia, Softbank, Susa Ventures, and TechCrunch (not an investor, but still good exposure).

How do people join the Investor Day audience?

We invite them, they apply, or they get invited by an investor who's already in the audience.

Investor Day is not shared publicly in order to keep the audience as high-value as possible for participating founders.

Want to apply or know someone that you think might be interested? Here’s the application page.

What types of companies are typically shared?

All types, but mostly Pre-Seed and Seed stage companies. All the startups we share are actively fundraising.

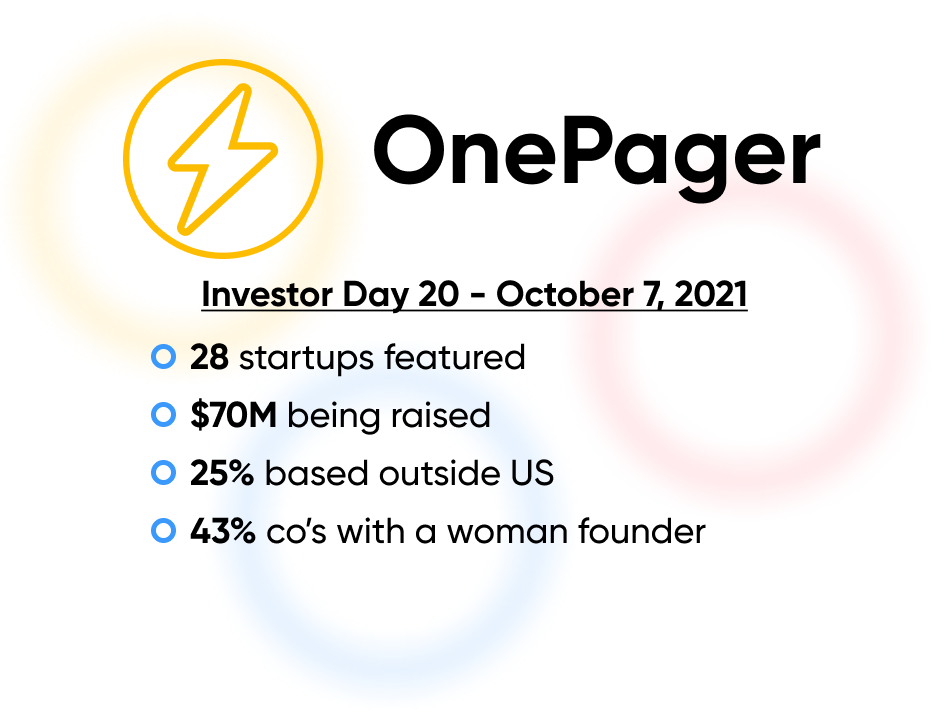

We’re proud to say that ~45% of the companies we share have a female co-founder and although ~75% are usually U.S. based we have shared companies from every continent (besides Antarctica, but it’s just a matter of time).

Here’s a snapshot of some of the data related to startups that use OnePager and that we ultimately share via Investor Day:

What does the newsletter look like?

Every Investor Day newsletter follows the same format and we use Substack to distribute it:

- A link to the OnePagers of all of the fundraising companies being shared.

- A "top picks" section from a guest investor or founder.

- An example of a recent success driven by Investor Day.

- Any relevant updates from our team.

How do you decide what's a "good" idea and worth sharing?

We don't. If a startup’s OnePager is complete we share it.

More specifics on what “complete” means and how you can follow OnePager best practices can be found in our post on the subject here.

Rather than putting ourselves in a position to be the arbiter of “good” or “bad” when it comes to the startups we share (something we think is very hard to do consistently) we focus on making it easy for the investors in our network to make that call for themselves. Our goal is to share startups in a way that makes it easy for investors to go through 10 companies in 30 minutes rather than sharing 1 “perfect” company that they spend 30 minutes learning about. This allows us to get more companies more exposure and it keeps us from trying to nail down each investor's specific preferences (also very hard to do).

How do I get involved?

If you're a fundraising founder: Click here

All you have to do is signup for OnePager and you will automatically receive updates about upcoming Investor Days. Follow the link above to learn more about the product and sign up.

If you’re an active investor: Click here

We’re always looking to expand the audience of investors we share OnePagers with. To sign up, just follow the link above to apply, and after a quick review we’ll be happy to include you.

Not a founder or investor (yet), but want to participate: Click here

We run a non-exclusive scout program called Open Scout that enables anyone to jump into the world of startups and investors. After an asynchronous onboarding process, scouts are able to help founders connect with our network of investors and learn by doing. Click above to see a more detailed page about that program and a form to apply.