OnePager Best Practices - Tell Your Best Fundraising Story

Nic Mahaney

Prev. OnePager Co-Founder

September 22nd, 2021

What is OnePager?

We built OnePager out of a basic necessity: the need to quickly aggregate company information in an attractive way for founders with other priorities. Pitch decks are a great way to get your story across, but after talking with hundreds of founders and investors, there was a need to share additional context and data outside of a pitch deck. So we created OnePager as an easy-to-use template for founders to share their pitch deck with context - metrics, FAQs, etc. - in a consumable format.

OnePager Best Practices

In this post, we’re going to break down every card available on OnePager to help you tell the best story to investors. Let’s get started!

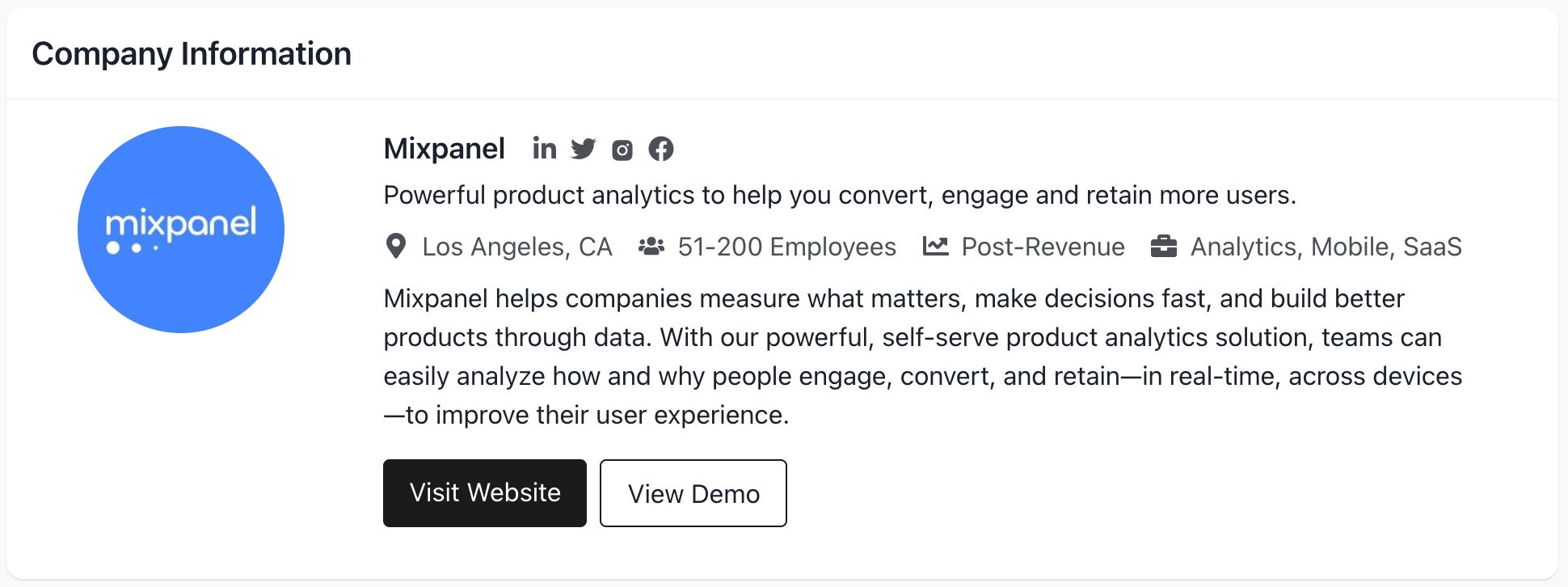

Company Information

Overview: This is the first thing any visitor to your OnePager sees about your company. The main goal of this card is to introduce your mission and what you’re building to incentivize people to get to the next card on your OnePager.

Focus on: Everything! Like I said, this is the most important card on your OnePager - this is the immediate eyeball test of “am I interested in this company?” by investors. Be sure to spend some time on your tagline and take advice from our CEO, Adam Hardej, on how to create a top tier company description.

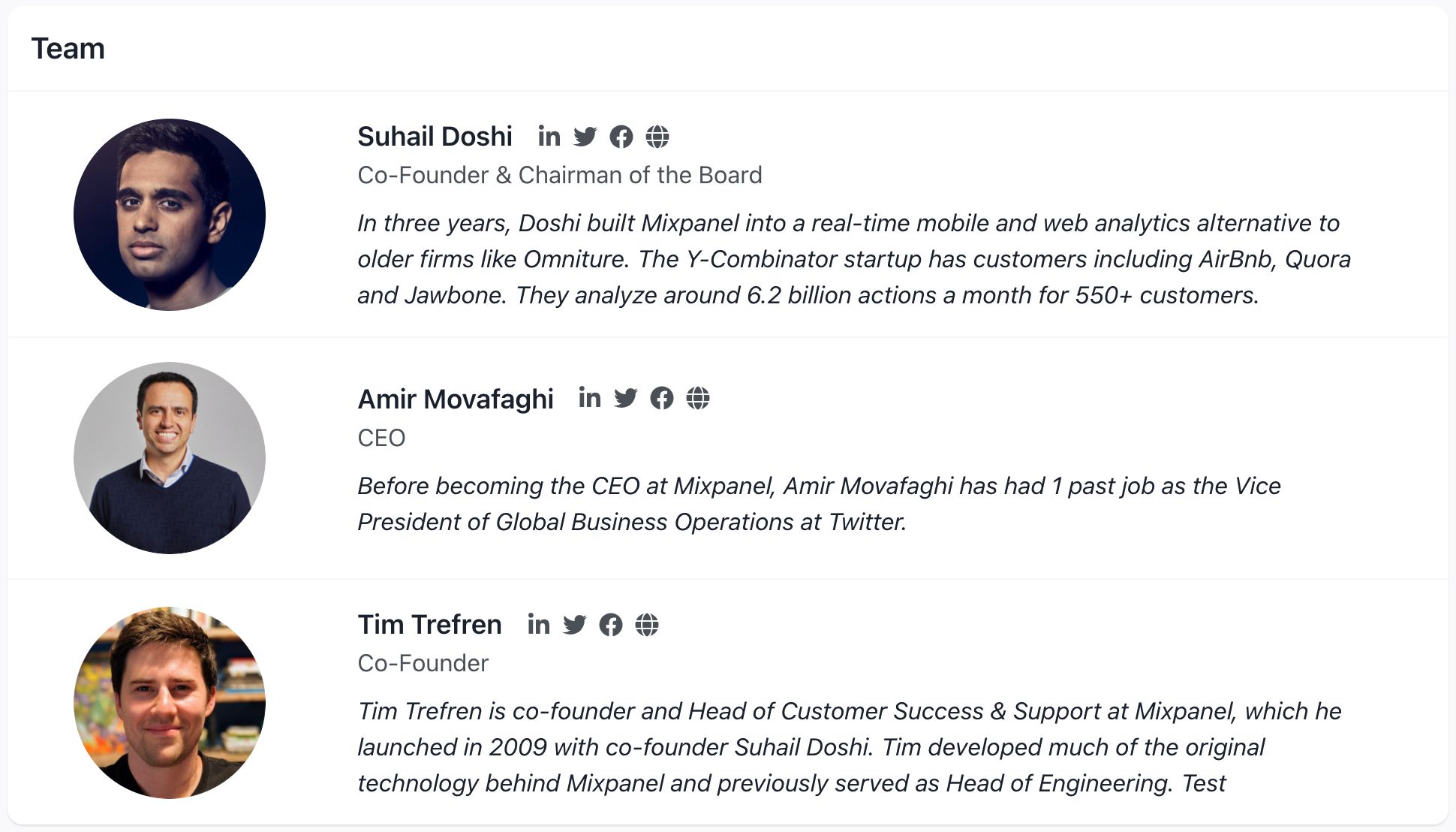

Team

Overview: One of the most important things to know about early-stage fundraising is that VCs and Angels invest in the team just as much as the product. Put your best foot forward and introduce who is leading the company you introduced in the card before.

Focus on: Leadership! When possible, try to keep this section to only founders or the 3-4 core leaders within the team. Also, be sure to include your social media accounts (specifically LinkedIn & Twitter) - without them, your visitors will copy & paste your name into Google. Make it easy for them to know who you are.

Overview: It’s very important to include a pitch deck in your OnePager for two reasons. The first is that investors absolutely love pitch decks - why? Because they’re very comfortable reading through them. The second is that pitch decks are an incredible exercise in creating a piece of consumable material that covers what your business is all about.

Focus on: Play the hits on your deck structure by following available templates! Specifically, if you are a pre-seed or seed stage company, follow along with Y Combinator’s How to Build Your Seed Round Pitch Deck by Aaron Harris. Also remember that you no longer have to cram everything into your pitch deck because you have OnePager to help you out.

Video

Overview: The video section is not a one size fits all card - it depends what stage you’re at and what you’re building. For some in the earlier stages, it’s a perfect opportunity to spend a minute (seriously - try to keep it to one minute!) to introduce your team, your mission, and your vision. If you’re later on in your company’s journey, you can use this video card to share a promotional video or a product demo so that OnePager visitors understand what you’re building.

Focus on: Telling the right story at the right time. This is an opportunity to literally speak with visitors before getting on a call. Follow along with some great Y Combinator introduction videos (Teespring & Flip), as well as a great product introduction and walkthrough for Mixpanel.

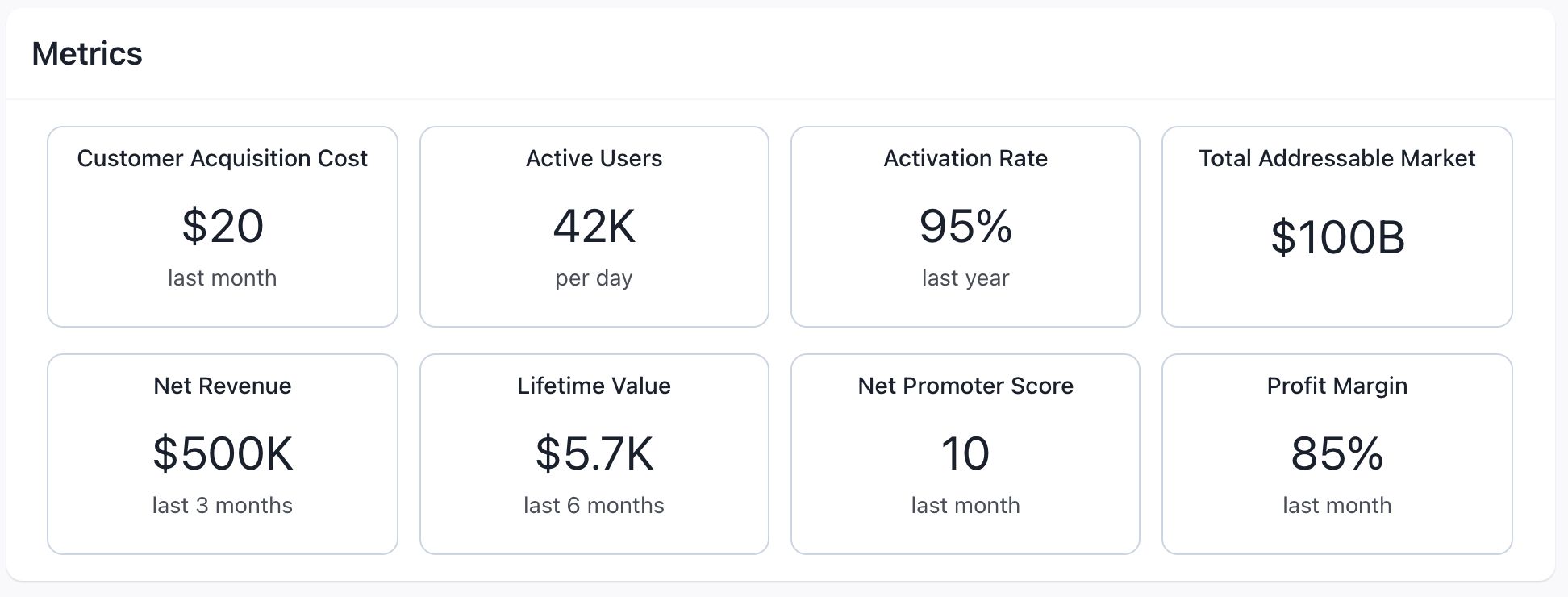

Metrics

Overview: The Metrics card is a great way to control the narrative of your company and opportunity when sharing information with investors. By preemptively sharing quantitative metrics, you can show both industry expertise and drive conversation by defining the metrics that matter most to your business.

Focus on: Only include metrics if you can add in 3-4 core metrics that drive your progress or exemplify your opportunity. If you are early in your journey, use metrics like Total Addressable Market, Site Traffic, and/or Waitlist. If your product is out in the market, focus on metrics that display your growth and customer retention.

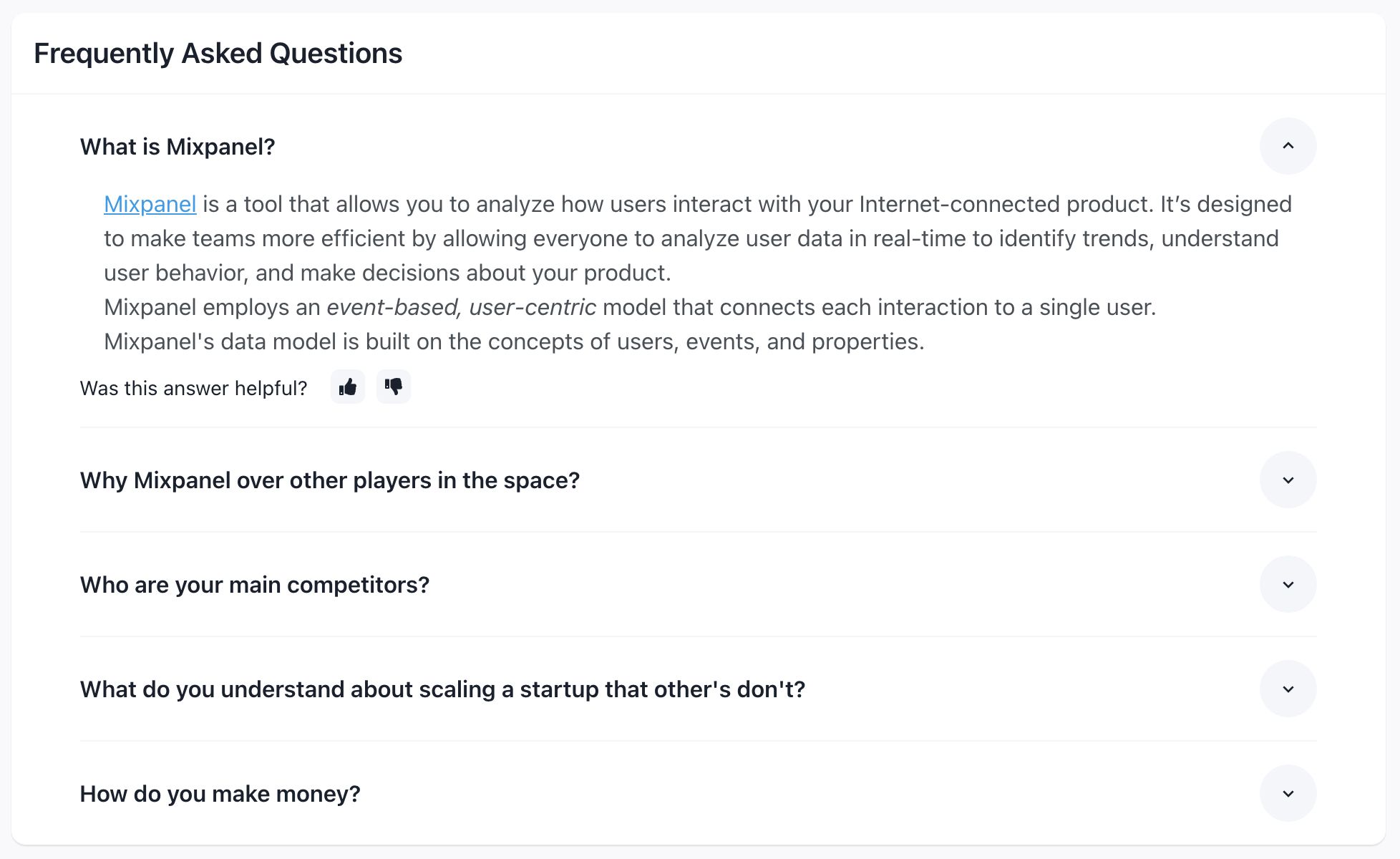

FAQs

Overview: Having great FAQs can be a major differentiator for investors deciding if they are interested in your company. This card is an opportunity to address topics that are difficult to get across in your pitch deck by writing longer form answers. Similarly to Metrics, this also provides a unique chance to drive the narrative by addressing tough questions without being put on the spot.

Focus on: Keep your FAQs short and sweet - investors have limited attention spans and fatigue quickly. Try to tighten your Answers to 5 sentences or less, and aim for 4 or 5 total FAQs. Successful companies tend to focus on acquisition strategy, growth strategy, why the time is right to build this, and how their team and/or product differentiate themselves from competitors.

Fundraising

Overview: This card is the simplest way for investors to know if you fall into their investment criteria. While there is an argument for strategically sharing how much you have raised or are raising, it is almost always better to be objective and straightforward with this information.

Focus on: Be clear on how much money you need and why. Share your terms and your target raise amount - it is very infrequent that hiding this information will be to your advantage. Also, try to include basic information in the Note field about what this money will do: fill out your product supply, hire new team members, etc.

Investors & Advisors

Overview: If you have an opportunity to show that other people believe in your business, show them off! Having a strong advisory board or group of notable investors can be a great motivator for others to become involved. This card is optional and not something you should be worried about if you are just getting started - focus on the core information at the top of the OnePager!

Focus on: Highlight your top investors and advisors. Similar to previously mentioned cards, visitors will get fatigued when reading through big groups of information, so go for a home run when saying who is involved. Be sure to include photos and social media accounts to make it easy to check who these people are!