What are SPVs and Rolling Funds?

Nic Mahaney

Prev. OnePager Co-Founder

October 21st, 2021

What's an SPV?

Overview

In venture, a special purpose vehicle, or SPV, helps investors pool their money into a single company that is designed for a specific investment in a single company. This is a major departure from the traditional venture fund structure that is set up to be invested in multiple companies, over a longer period of time. Unlike Rolling Funds, which we’ll cover below, SPVs are not entirely new. For years, financial institutions have used SPVs as investment vehicles - most notably with Enron.

General partners at venture funds have traditionally used SPVs for two reasons: investing in companies that fall outside of their fund’s criteria or for a follow-on investment when their fund does not have enough capital. Both of these situations allow LPs in a fund to make individual decisions on their involvement, rather than their capital being deployed as a bigger part of that fund.

What is new about SPVs in recent years, however, is newer investors (not famous GPs or angels) using SPVs to raise money for a singular investment. This allows them to circumvent raising from LPs on an investment thesis, and lets them develop a reputation for quality deal flow in the venture capital world.

One important note about SPVs is that investing in an SPV is not the same as investing in the company itself. The investors in the SPV receive a stake of ownership or interest in the SPV, which will eventually own a stake of interest in the underlying portfolio company. Also similar to traditional funds, SPVs are charged fees for the GPs to manage the SPV and to receive carried interest in the success of the SPV.

What are the potential benefits of an SPV?

- Founders can maintain a clean cap table. Fundraising is hard - managing 20 investors of $5k checks is time consuming and generally suggested against. SPVs make this easier for founders.

- SPVs increase access to investors of all sizes. Traditionally, lower-check investors did not have the ability to invest $1-5k into a company, but with SPVs, they can invest a lower amount into a larger investment.

- Creators of SPVs are able to network themselves and build a reputation as a curator of deal flow. For early GPs, this provides them the ability to create syndicates before raising a larger fund

What are the potential downsides of an SPV?

- Investing in an SPV is an all-or-nothing investment, since it only invests into a single company, rather than diversifying a larger amount of capital into multiple companies.

- LPs inside an SPV do not get voting rights in the company the SPV invests in because they are only investors in the SPV itself.

- SPVs typically have a similar 2/20 model to traditional funds. Managers of the SPV will take between 0%-2% out of total capital allocated into the SPV, as well as carried interest for all profits made by the underlying company. This is typically seen as paying for access to deal flow, but can be predatory in specific instances.

What’s a Rolling Fund?

Overview

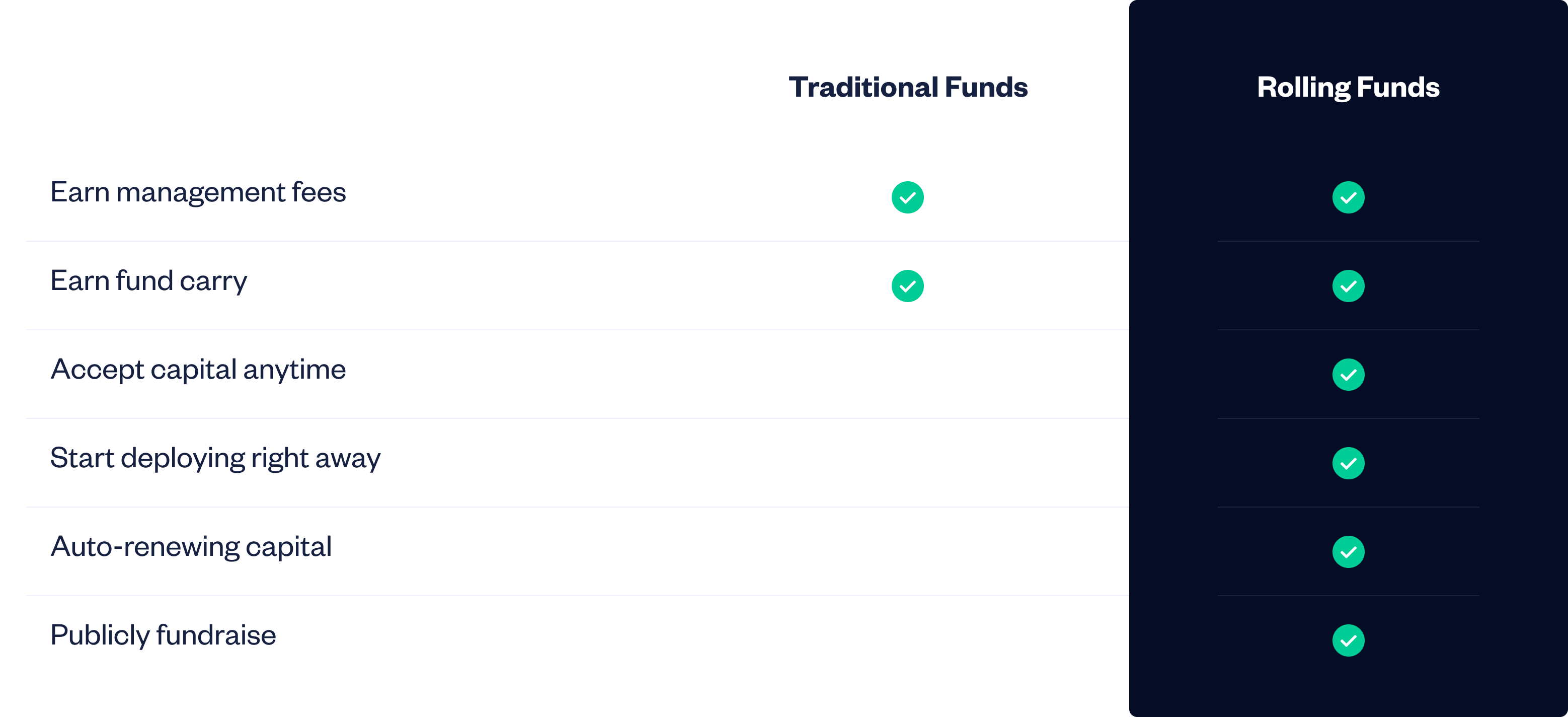

Rolling Funds were introduced by AngelList in early 2020 as a way to bring high-resolution fundraising to venture funds. Instead of requiring a massive upfront commitment from investors, fund managers can accept a recurring investment from LPs to invest quarterly. On top of recurring capital from existing LPs over time, rolling funds also allow fund managers to accept capital at any time.

As mentioned above, Rolling Funds are an entirely new model and investment vehicle. Fund managers can now start investing in companies faster and with a smaller capital pool than ever before. Fund managers can remarket their fund as they have success and grow that capital pool to further increase their investment opportunity.

As Naval Ravikant, founder and chairman of AngelList, puts it:

The huge benefit for a fund manager is that they can raise money incrementally, one investor at a time, rather than having to do a one-time, big-bang fundraise and then lock the fund for four years

Benefits

- Fund managers no longer have to raise an entire fund up front. After a base level of capital commitments, they can start investing.

- Remarketing the fund after a portfolio markup is seamless and makes it easy to accept new capital. Marketing this fund is also legally compliant with the SEC regulation on public solicitation for investment

- It’s a single fund that’s size is continuously increasing, removing the need for raising multiple funds over and over.

Pitfalls

- One of the downsides to being so agile with a Rolling Fund is that LP commitment is not as set-in-stone as it is for a traditional fund. Capital can churn in a Rolling Fund, whereas traditional venture funds have capital commitments for the entire duration of the fund.