Venture Capital

Nic Mahaney

Prev. OnePager Co-Founder

September 3rd, 2021

What is Venture Capital?

Venture capital is a type of financing method in which wealthy investors provide capital to startups or small businesses that have the potential for long-term growth. In addition to monetary support, VC firms often provide their portfolio companies with mentorship in technical or managerial aspects. It can be incredibly risky for investors since 9 out of 10 start-ups fail, but the potential massive return margins are also very enticing (Patel).

History of Venture Capital

The beginnings of VC can be traced back to the 1940s, when the “Father of VC'', Harvard Business School professor, George Doriot, founded American Research and Development Corporation (ARDC). ARDC specialized in funding technologies that were developed during WWII, the first being an X-ray machine used for cancer treatment (Powers). This investment was a huge success and generated massive returns for Doriot. One of Doriot’s most notable philosophies was that the VC firm should actively partake in the company’s development, including providing counsel and support to the entrepreneurs. To date, most VC investors still adhere to this philosophy (Chen).

Small Business Investment Act of 1958

A monumental bill that kickstarted the VC industry was the Small Business Investment Act of 1958. This Act essentially allowed the U.S. Small Business Administration to grant private equity firms the ability to finance and manage small entrepreneurial companies.

Following the passing of this bill in the 1960s and 1970s, the VC industry primarily invested in companies that were developing electronic, medical, or data processing technologies; this led the VC name to be tied closely with the technology development industry. It was during this time period in which the current model of general partners and passive limited partners developed. General partners controlled the investment opportunities, while the limited partners put up the capital (Powers).

Early Growth in the 80s

Although there was some early activity of VC investment in the 1960s and 1970s, the industry didn’t really take off until the 1980s. (Powers). When the economy started to improve following the recession at the end of the 1970s, the IPO market also increased in size, providing more opportunities for start-up companies to exit and make a profit for their investors.

The VC industry became more competitive and expensive, as the price tags on startups rose by 20% - 100%. The sheer number of VC firms also rose dramatically: two-thirds of firms in 1983 had not existed 5 years before. In 1983, an unprecedented number of companies also went public, including Amgen, Biogen, LSI, Apollo, Compaq. These companies generated an astonishing 30%-50% return that year for investors (Neumann).

The Dot-com Bubble

In the first two years of the 2000s, the VC industry saw an unprecedented crash in NASDAQ that was caused by the meteoric rise in valuations for technology companies during the bull market in the 1990s. This is known as the dot com bubble. After the crash, it took nearly 12 years for the economy to recover to the peak of the bubble.

As internet use was on the rise, VC firms started pouring money into the start-ups in the industry. Many investors took a more optimistic approach when screening investment opportunities out of false confidence that any start-up in this surging industry would return capital. They were anxious to find the next technology “unicorns” and began freely investing in any company with a “.com” in the pitch.

By 1999, 40% of VC funds were going to internet companies. However, a lot of these companies didn’t focus on developing their technology; but rather, focused on beating the competition, and in turn spent a fortune on marketing efforts. This led to the crash in 2000, when the bubble burst, leaving many investors with steep losses and internet companies going out of business (Hayes).

Speaking in broader terms, VC investments generate a substantial amount of profit for investors: “The National Venture Capital Association reports that companies financed in their early stages by VC account for over 20 percent of the US GDP today. The most successful investments of this generation have, in fact, come from VCs able to identify major industry disruptors before they fully reach the market.” (Ayan). However, investing in VC is also incredibly risky as about three-quarters of venture-backed firms in the U.S. don’t return investors’ capital according to a review done by Harvard Business School.

Entrepreneurial Hubs

The popularity of innovation hubs in the US has been on the rise. A study released in 2016 showed that there are many hubs emerging in smaller, mid-tier cities such as Raleigh-Durham of North Carolina, Salt Lake City, Jacksonville, and Nashville. Although the San Francisco Bay Area and the Northeast of the US still bring in the most profit, smaller cities make the top ten for attracting investors from VC, likely because it is where ambitious founders want to live (Rose).

What is an Entrepreneurial Startup Hub?

The term “entrepreneurial hub” is loosely defined, but there are a few key features that all hubs have. Startup hubs provide founders with a professional environment and expertise in how to grow their companies (Petch). These hubs often offer a physical location where many founders can come together to share ideas and resources.

While each may be working on an individual project, this collaborative community promotes the exchanging of heterogeneous knowledge from people of diverse fields and backgrounds - examples include artists, software engineers, students, managers, etc.

In addition, while most hubs offer physical facilities to encourage the teamwork aspect of building a start-up, many hubs also have a digital aspect that extends their outreach to a broader network (Friederici).

An example of an up and rising hub is the Triangle area in North Carolina. The area was ranked as the second-best place for businesses and careers for the third straight year in 2018. The venture funding raised in this area increased by 154% to $2.57 billion dollars from the previous year - notable recent billion-dollar deals include Epic Games and Red Hat (Azevedo).

Entrepreneurship in Singapore

On an international level, Singapore has been attracting attention as a developing start-up hub with great potential. Singapore has strong research institutions and open immigration policies for skilled workers, promoting the fluidity of ideas.

In 2015, “Block 71”, a building close to the National University of Singapore, was named “the world’s most tightly packed entrepreneurial ecosystem.” One reason that Singapore has seen such major development in entrepreneurship in the past few years is because of heavy government involvement.

In 2008, Singapore launched an initiative called the Early Stage Venture Investment Fund, which allowed five VC companies to receive matching funding from the government. Additionally, political leaders have also leveraged their power to promote the importance of innovation through school-sponsored programs, television ads, etc (Anthony).

How does one directly go about creating an entrepreneurial hub in a city? According to Forbes, there are a few steps that people can take to create a vibrant start-up community similar to the one in the Research Triangle in North Carolina.

Author Joan Siefert Rose mentions that although real estate is important, it is not the most important part of a successful hub. Without programs and network events in place, founders can only benefit so much from a nice physical workspace. Another tip she has is to figure out what sector the city’s growth should focus on. The Triangle area, for example, focuses on the agriculture-tech industry, because there is already a base of networks and resources to build upon for aspiring founders.

Thirdly, she mentions the importance of engaging the successful entrepreneurs in the community and giving them a platform to share their experiences. Lastly, Rose cautions against hosting too many networking events and thus overwhelming the founders.

Why Location Matters

Why is creating an entrepreneurial environment so important to a city? It turns out there are major economic benefits that come with thriving start-ups.

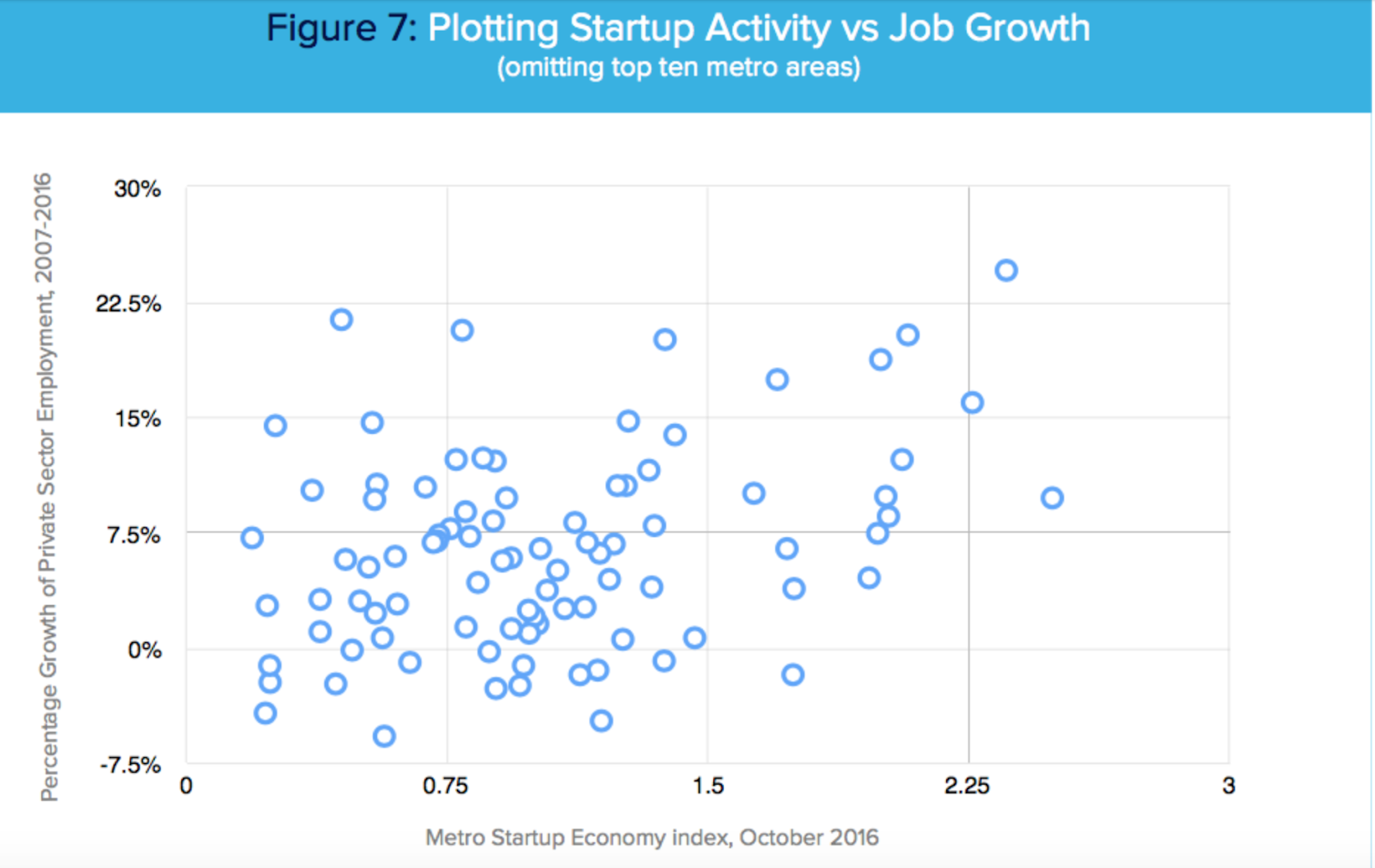

As one study reported, “the top 25 metro areasfor startup growth averaged 11.9 percent private-sector job growth over a nine-year period ending in 2016. Areas with lower levels of startup activity averaged less than half that growth.” From the plot below, we can see that there is a clear correlation between job growth and the value of the Metro Startup Economy Index (Mandel):

Social Benefits of Entrepreneurship

Not surprisingly, VC has now become a major part of the US’ economic development due to the social benefits entrepreneurship brings. In fact, one-fifth of current public US companies received VC funding in the early stages.

In a study conducted by Stanford Business School, out of 4,063 companies sampled, 18% of them were VC backed. They made up $4.3 trillion in total market capitalization and employed 4 million people. Looking at the bigger scope, VC companies account for 42% of all R&D spending by US public companies. This R&D spending produces value for not just those companies, but also the global innovation space as a whole.

Due to the increasingly large proportion that VC backed start-ups hold in the business industry, they have been a prime driver for both economic development and private sector employment for the past few decades (Strebulaev).

Structures and Strategies

As a founder raising money, it is important to understand the incentives from the investor’s side. Outside of family and friends, the two main types of investors you’ll interact with are VC firms and angel investors, both of which have their similarities and differences in incentive.

Venture Capital Firms

VC firms are working to make returns for their limited partners or LP (institutional or individual investors that don’t have much say in the investment process) (Cremades). When venture capitalists invest in a start-up, they purchase a portion of the stock, which are generally illiquid (i.e cannot be easily converted into cash). It is also usually preferred stock, meaning the investors have more control over how the stock is distributed if the company exits. Therefore, the only way for VC firms to return capital for their LP is to push the company to exit, meaning either go public or be bought out.

This is crucial information because this implies that start-ups that don’t have a realistic shot of going public won’t receive VC funds. The VC business model simply doesn’t work without the company exiting. It also means that if you do get VC money, they will push you to grow your company, sometimes at an unreasonable rate, which could end up being the cause of a company’s downfall (Kanies).

One thing to keep in mind when accepting VC funding is that the founder gives up some control of the company. It’s important for the founder to recognize that there are many strings attached by accepting the investment and consider the trade offs (Prosser).

Angel Investors

Angel investors are wealthy individuals who invest their own money in companies. Angels come from a variety of backgrounds: some made money through their own start-ups, some are from other working industries, and some inherited their wealth.

Angel investors are similar to venture capitalists in that they both want to make money, but Angel investors have much more diverse profiles in terms of experience, interests, and amount of money they want to invest. Specifically, some Angels might just want the right to brag about investing in a start-up, no matter how successful; others might have very little experience and just throw money at the first company they hear from (Spearman).

Angel investors also primarily invest in the seed funding stage, rather than all stages like VC firms (Thopsey). Similar to venture capitalists, angel investors also take over some control in the company and may push the founder to make decisions that he/she is not fully on board with.

Because there is not a generic contract of how all investors should act, it is incredibly important for the founder to have a good understanding of the angel investor’s motives and experiences in the industry before deciding to get in business with them.

How Venture Capital Works

Let’s take a closer look at how exactly VC works. There are four key parts to the VC business model. The first is the managing company which is the firm that the venture capitalists invest under. The company receives around 2% of the fund in fees to cover overhead costs such as rent and salaries of employees. Second are the limited partners, the investors to commit capital to the fund. These people usually represent the interests of institutions, pension funds, insurance companies, etc. Third are the general partners, the partners of the managing company who carry out the logistics of raising a venture fund and helping develop their portfolio companies (Sun). General partners split around 20% of the profits generated from the fund (Takatkah). Lastly are the portfolio companies, who are the ones receiving the investment and building their start-up (Sun).

Funds usually have a lifetime of around 7 to 10 years, although it only actively invests in the first 3 to 4 years. Fundraising for investment pools usually takes around 3 years, which happens in conjunction with the active investment period.

Most firms make around 20 - 40 investments these first few years, with each investment being 1 - 2% of the total capital. The rest of the fund (around 50%) is used for follow up investments on existing portfolio companies. If a company needs more time than the 10 years that a fund is operating in, they may apply for a 1 - 2 year extension that has to be approved by the limited partners (Polovetz).

Firms usually have multiple funds running at the same time, but only one is actively investing (Sun). The goal is to have one fund’s active investing period begin right as another one’s investment period ends (Polovetz).

Startup Venture Capital

Contrary to popular perception, only a small portion of VC funding goes to start-ups (around 6%) (Zider). The majority of funding is invested in projects already developed through government or corporation expenditures. The VC money that does get invested in start-ups, however, plays a vital role in building the infrastructures required to grow the business. They are usually not long term investments.

VC’s business model runs off of buying a stake in a founder’s idea, developing the company in a short amount of time, and pushing the business to exit to liquidate their stakes to return to investors. VC’s also focus on specific industries that they believe have great potential. They focus on the middle part of the industry growth curve and avoid both the early stages where technologies are underdeveloped and the later stages where growth rates slow down.

Most of the time, VC’s are conservative in which types of industry they invest in; they will only invest in those that have already shown growth. Therefore, with the industry already proven to have potential, the main risk for VC investors is the execution of the company, for which they play a heavy role in moderating (Zider).

Trends in the VC industry

Karan Mehandru, a triple “unicorn” investor at Trinity Ventures, offers his insight on how the VC industry will develop in the near future. Mehandru is an early investor in Cohesity, Outreach, and Autho, allowing him to have more “unicorn” companies in his portfolio than most firms as a whole.

Traditionally, founders have had to suck up to venture capitalists, despite the horrible treatment they often endured, perpetuating an imbalance of power. However, Mehandru thinks that with the surge in VC funding, the power will shift into the hands of promising founders as the option for partners increases.

Secondly, there has also been a push in the industry for venture capitalists to be more hands on in managing the company operations, but take less of a “grow at all cost” mindset.

Lastly, Mehandru highly encourages more diversity in all dimensions for VC investment teams (Robert). A study done by Harvard Business School has shown that diverse teams outperform non-diverse teams by far (Blanding), yet most VC teams are still white middle aged males with similar education and socioeconomic backgrounds.

Gender diversity is especially important, as more and more companies are being founded by women. More capital was invested in companies founded or co-founded by women in 4Q 2018 than in any other quarter in the past decade (Mathur). As founders gain more power in the partnership, they’ll seek out investors who can understand and sympathize with their own personal experiences and ethnic backgrounds.