Demographics and Democratization

Nic Mahaney

Prev. OnePager Co-Founder

September 5th, 2021

Where We Came From

Historically, much of the finance world has been dominated by men, of whom are primarily white. Many African American finance hubs, including Black Wall Street in Tulsa, have faced economic zoning issues, lack of funding, and hate crimes (Holman). This, combined with low rates of minorities and women attending colleges during the early 20th century, led to minorities and women being excluded from the financial world (Clark).

This was especially true in venture capital, as the earliest VC investing was done by the rich during the gilded age. This includes household names such as Carnegie, Vanderbilt, and Rockefeller. During this time, segregation was still legal and women were yet to receive their suffrage (Clark). These segregation issues led to minorities and women being vastly underrepresented in the venture capital industry, which is still a staple of the current landscape today.

Where We Are

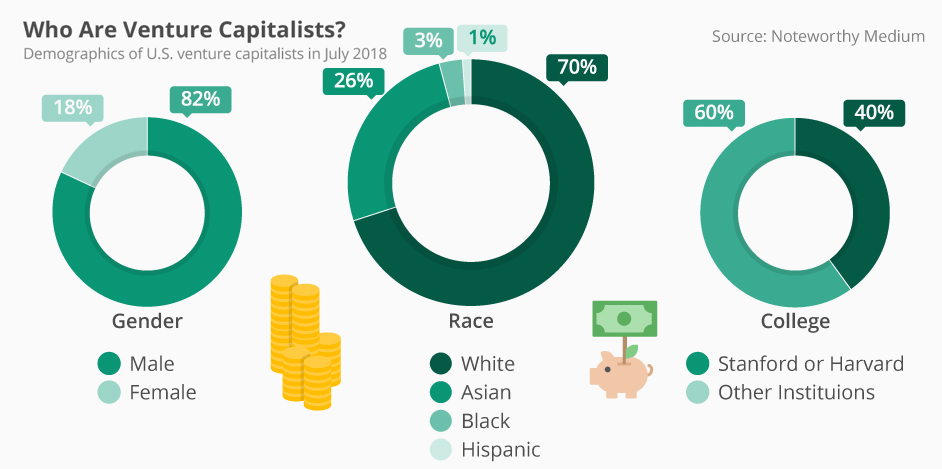

In today’s world, we still are yet to achieve real diversity in the venture capital space; a majority of VC firms do not have a single black investor (Clark). A Deloitte research study showed that there is a lack of diversity on both the investor and founder sides (NVCA). Many of these venture capital firms operate as old boys clubs, investing in and hiring folks who have common connections as a result of warm introductions. Common connections often include race, gender, income, status, and a university degree (Kerby).

Companies like Deloitte have made attempts to improve diversity and inclusion. They have worked to conduct studies that display better statistics on diversity. However, these statistics tell the same story: women and minorities are extremely underrepresented in the venture capital industry (NVCA).

Ethnic Matching

One reason why there is a lack of diversity is ethnic matching. Ethnic matching is a process by which people are more likely to hire others who look like themselves. Because employees at VC funds and investors that VC funds have invested behind have been mostly white males, VC firms have chosen to favor the hiring of white males and investing in white founders (Hsu).

Venture capital firms tend to invest in specific locations. Silicon Valley received 42% of venture capital dollars spent; this lack of geographic diversity helps keep the industry incredibly homogenous (Shieber).

Education

The VC industry lacks diversity with regards to the schools it recruits and hires from. The industry is full of HBS and Wharton graduates, with most VC analysts having attended an elite university. Most students from state colleges, or otherwise, are unable to get positions at these companies, as they are reserved for children of the elite who go to prestigious universities (Kerby). This has led to a homogenous and majority white and male pipeline.

What is Democratization?

What is democratization? Democratization is the practice whereby something is made accessible to the masses. Currently, the industry is being revamped, as teams are looking to make the venture capital industry accessible to everyone. As of right now, the majority of VC firms are primarily funded by rich investors.

However, there is a new approach to VC funding emerging: crowdfunding.Rather than a single firm putting up the money for the investment, there are new approaches that allow for people to fundraise money for a company together, a collective of thousands of people owning a small stake in a company.

This approach allows for the everyday person to invest in the VC industry (Guttman). This democratization is similar to what Robinhood is currently doing for the stock market industry; Robinhood has made it easier for users to invest, offering fractional shares, easy to navigate UI, and tips for investing. This, along with the mobile app, has allowed for stock market accessibility to be expanded to a broader network of investors. This same approach is currently underway in the VC industry.

Lack of Diversity in Venture Capital

So what effect does the lack of diversity have on the VC industry? Many experts say that this self-imposed segregation in finance costs us billions of dollars a year (Applewhite) as an economy.

As more and more early-stage founders have started to become diverse, early-stage financing has slowed down. Instead, VC firms are investing in bigger already established startups.

The lack of diversity also has an effect on the founder side. Most startup companies that lack diversity ends up failing. They lack the diverse opinions needed to ensure that the company is innovative and that their product targets a wide variety of people.

Where We're Headed

Recent data has shown conflicting evidence: we are making strides towards equity in VC and increased access for all people, but minorities still face immense discrimination in the VC space. Progress is being made, but not at the speed that is necessary. So what should future plans look like?

Venture capital firms have recently been shoring up their images, following the killings of Ahmed Arbery, George Floyd, and countless others; they have released statements affirming their commitment to a diverse workplace and a diverse America (Rosalie).

However, many question their true motives and point to their troubled pasts. Many are calling for these firms to make pledges, to invest a certain amount in black-owned startups, to hire a certain amount of POC workers, to improve gender diversity, and work towards eliminating the wage gap. These types of actions must be taken to ensure that VC continues to grow at the clip that it has over the past fifty years.

In terms of democratization, new types of fundraising have arisen; by combining the investment pools of millions, users can get a fractional gain in a VC investment. This increases the number of people who can invest in VC, allowing for widespread access and democratization in the industry.

Diversity in the Workplace

When looking at diversity in the workplace, especially in venture capital, it is important to take note of the pipelines that allow people to get jobs at any given company.

Most VC firms tend to hire students that either went to their highly ranked university, were a part of their social group, or are friends and family. These practices tend to lead to VC firms hiring candidates that mirror the racial makeup of the people who hire them.

The pipelines for students to get jobs at VC firms and high impact early startups works to discriminate against applicants of color; warm introduction also favor white and wealthy student students as these are the students that are more likely to have the connections that are required to get one of these jobs (Dickey)(Hassan).

Women in Venture Capital

In the past few years, women have started to receive more funding from venture capital firms. Although this is good news, women still face many more challenges than men in the venture capital field (Hassan).

For example, women are likely to be asked more pressing questions than men are during pitch interviews (Kanze). Recordings of venture capital firm conversations show that women are talked about differently in conversations; firms often focus on their personality rather than the merit of their startup (Malmstrom).

Women are dealt an unfair card in the world of venture capital and, despite a relative increase in funding, they still face challenges. One challenge that women face in every industry is the glass ceiling. The VC world is no different as women hold virtually no positions of power across the entire industry (Schleifer).

Making the Venture Capital Industry More Inclusive

How can we make the VC industry more inclusive? It will take more than improved recruiting methods to make the VC industry more inclusive. It will start with a complete overhaul of how VCs choose founders and how they recruit people for their own company.

Resources

Guide For Venture Capital Firms Attempting to Improve Diversity

Women's Business Resources

Provides information on Women Impacting Public Policy, a national nonpartisan public policy organization that advocates for and on the behalf of women and minorities in business in the legislative process to help create economic opportunities and build alliances to other small business organizations.

Provides women business owners and entrepreneurs with a variety of support and services, including help in securing rounds of venture capital.

Provides information on an association committed to helping women entrepreneurs become effective in economic, social and political spheres of power.

Offers access to powerful research on women entrepreneurship.

Enables you to get free and confidential business advice from mentors, both online and in-person.