Power and Possibility of the Crowded Cap Table

Jack O'Brien

Prev. OnePager Co-Founder

October 29th, 2021

A clean cap table used to be a badge of honor for startups. Having an extremely limited number of line items on your pre-seed, seed, and series A rounds from reputable angels and venture firms made investor relations simpler and generally signaled a hot company. Many founders continue to raise like this today, but “crowded” cap tables are becoming more possible, accepted, and a benefit for growing companies.

This change is driven by a few trends: the tech market is massively expanding, more investors are moving their capital into the private markets, and it’s never been easier to build a following. On top of all this, the SEC recently expanded the crowdfunding limit for startups from $1 million to $5 million, meaning unaccredited investors can bet on a wider variety of companies.

Founders that can create a following and tap into these new investors are able to find fundraising opportunities faster. Just as valuable, they gain a larger and more diverse group of loyal supporters.

It’s no longer uncommon to hear of founders raising million dollar rounds from 20+ individual angels, and that alone is a signal (we hear about deals like this from OnePager founders often). But that amount of outreach takes time, and luckily other financial tools are bringing more investors into the fold more easily.

- SPVs and RUVs allow investors access to high quality individual deals with commitment as low as $1000 per deal.

- Rolling funds open startup investing to investors wanting to diversify via temporary commitments of as little as $1000 per quarter.

- Venture crowdfunding sites like Republic and WeFunder have made it possible for anyone to invest as little as $100 into a particular startup.

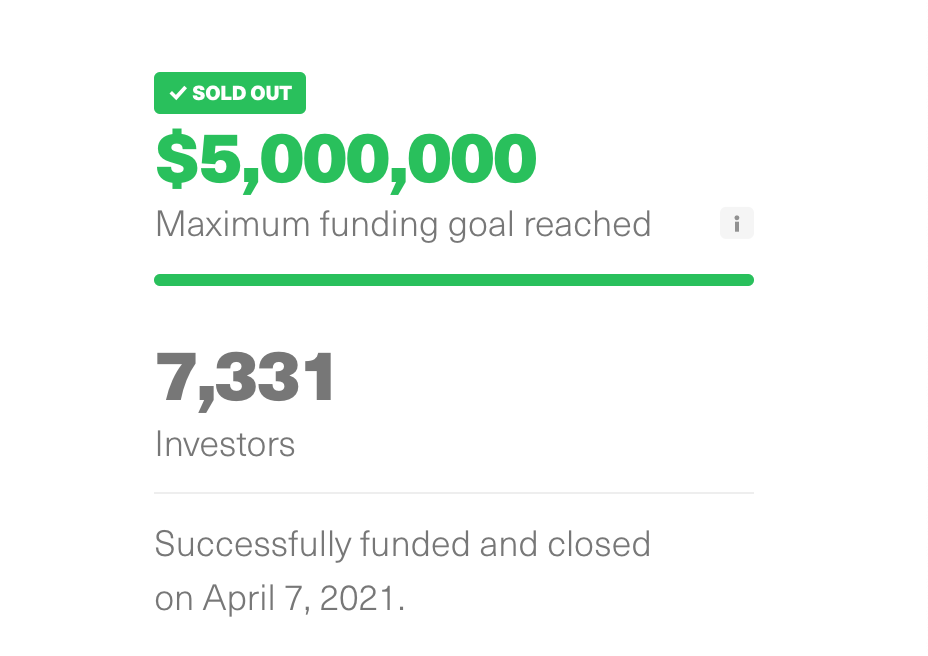

The result: founders get funded, and more people are included. Earlier this year Sahil Lavingia, founder of Gumroad, raised $5 Million from 7,331 unique investors in 12 hours (note the image for this blog post). The raise was the biggest equity crowdfunding event in history, and it showed that raising legitimate funding from large groups was possible.

Many investors, accredited or not, can now be neatly wrapped into various financial rollup vehicles. Each investor comes a vested interest to help the company make warm introductions, hire the right people, and share a wider range of ideas to help their investment succeed. It’s still not easy to found a company, but having a wide and committed support network of investors is now a possibility. It may even be a route to fundraising faster.

Startup Fundraising Similarities on Crypto & NFT Communities

This shift in distributed fundraising for businesses mirrors the dynamics in crypto and NFT communities. Tokens increase in value with a significant number of owners and broad adoption. An NFT collection is most valuable if a thousand users participate in the community, rather than a few majority owners after a big release.

These similarities between fundraising and crypto aren't a coincidence, and the trend will continue as access expands. All you need to join a crypto community is internet access, and until recently it’s been difficult or even illegal for individuals to invest in startups. Both are risky ventures that require investment, but one was only possible for a small percentage of people.

As it becomes more accessible for individuals to invest in startups, it will become more acceptable for founders to give away broader, fractional ownership for financing. Just like crypto, I think there’s a strength in numbers to startup fundraising.