How to Pitch your Pre-Seed Startup Effectively with OnePager

Adam Hardej

Prev. OnePager Co-Founder

September 20th, 2021

Every week over 100+ startups sign up to use OnePager and most of them are pre-seed startups who are either actively fundraising or about to get started. We’re building OnePager to help founders find the right resources and a big part of how we do that is by helping them put their best foot forward when it comes to fundraising. In this post I’ll explain the three pieces of advice we always share with our fundraising users:

1. Recognize that investors have limited attention spans

2. “Move the Goalposts” and adjust your materials accordingly

3. Understand that low conversion rates are standard

If this all sounds interesting, every other Tuesday (at 2pm EST) we run a OnePager Best Practices webinar to walk through these points live and answer questions. To take it a step further, every other Thursday we help OnePager users get in front of some of the best investors in the world through our Investor Day Newsletter that sends OnePagers to over 700 active investors. We’re proud to have facilitated some amazing connections through Investor Day and you can read more about that from the investor point of view here: How a Newsletter Led to a $6M Round.

Let’s get started!

Recognize Limited Attention Spans

Investors are famously busy. Full inboxes. Back-to-back calls. Everyone is asking them for money all day long and it’s their job to sort through the noise to find great companies. One of the best things you can do as a fundraising founder is to recognize this busyness and make it as easy as possible for an investor to get interested in what you’re doing quickly.

Don’t bury the most exciting part of your startup deep in your materials! Bring it front and center. If you bury it, there’s a chance an investor will lose interest before they get to the most exciting part.

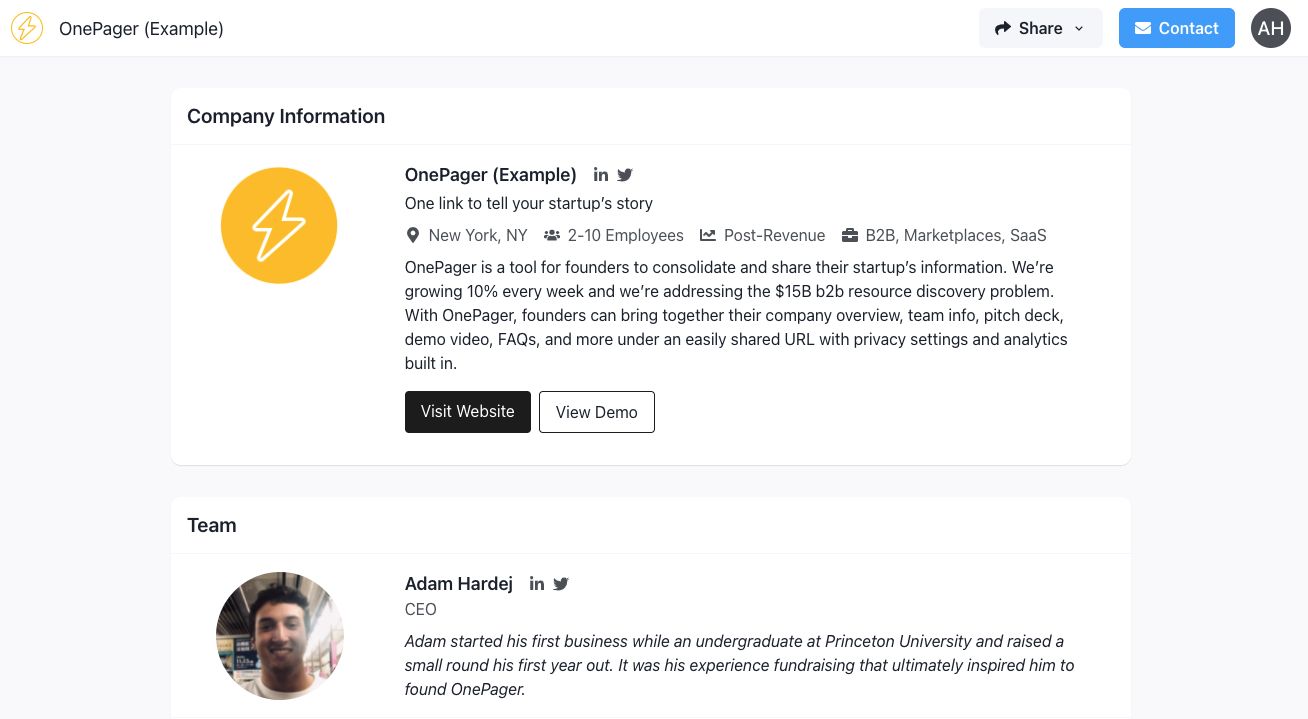

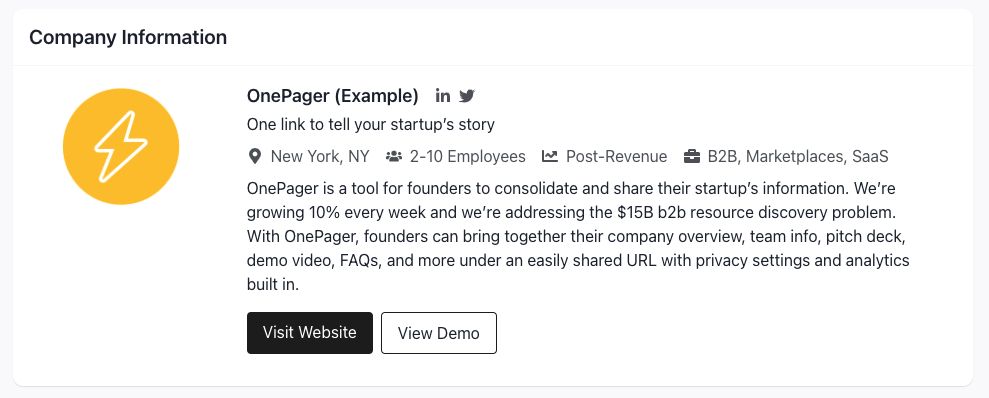

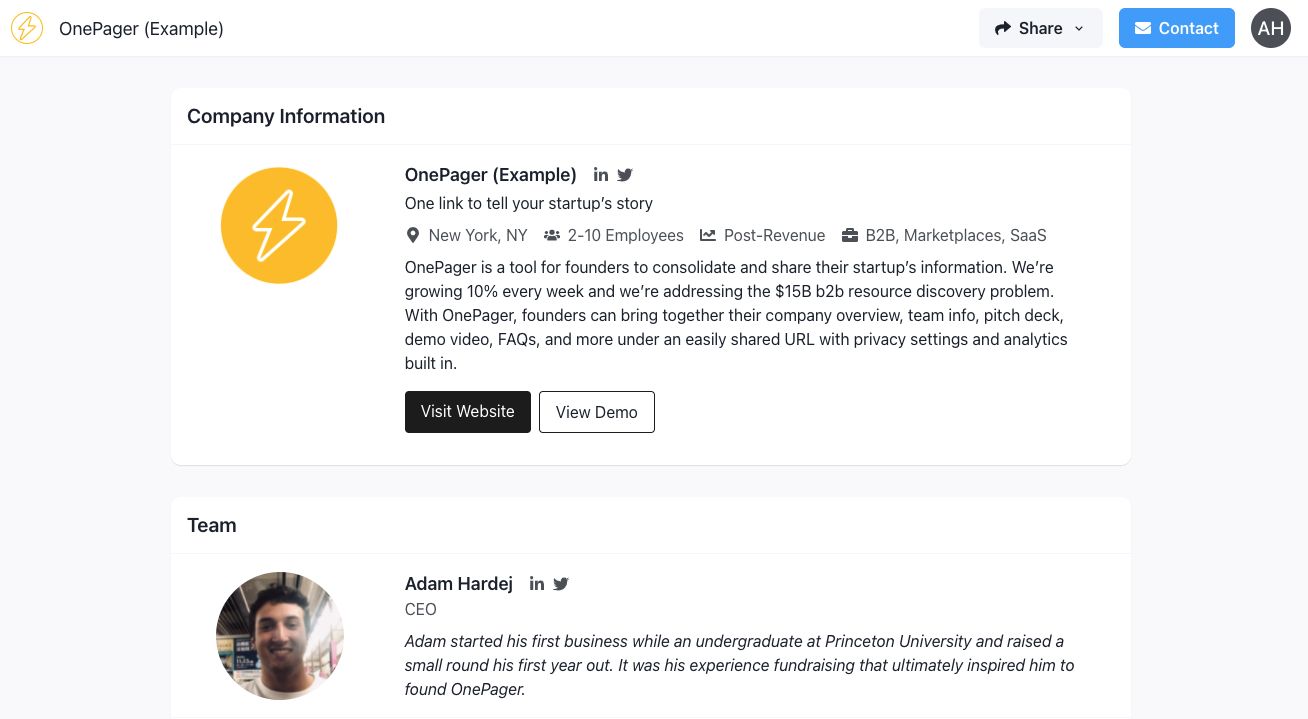

In practice, one suggestion we make is that our users bring an exciting stat or highlight into the “description” section of their OnePager so it’s one of the first things an investor sees. More generally, this is referred to as including something “above the fold” and the principle originated in the newspaper industry. Here are a few examples what I’m talking about:

Bad description (don’t do this) - “OnePager is a company that works with startups.”

OK description - “OnePager is a tool for founders to consolidate and share their startup’s information. With OnePager, founders can bring together their company overview, team info, pitch deck, demo video, FAQs, and more under an easily shared URL with privacy settings and analytics built in.”

Great description example - “OnePager is a tool for founders to consolidate and share their startup’s information. We’re growing 10% every week and we’re addressing the $15B b2b resource discovery problem. With OnePager, founders can bring together their company overview, team info, pitch deck, demo video, FAQs, and more under an easily shared URL with privacy settings and analytics built in.”

Check out the full example OnePager here: https://onepager.vc/demo

The difference between an “OK” description and a “Great” description is that it includes some exciting information about your startup as soon as possible. This is the type of hook you want to include so that the reader (the investor) is interested and sticks around.

This is just one example of how you can recognize the limited attention span of investors and try to get out in front of it. It’s important to keep this theme in mind throughout your materials! Always think to yourself: Could I say this with fewer words? If I was a pre-seed investor, would this make me want to keep reading?

Looking for more content about this? Check out YC’s How to Get Meetings with Investors and Raise Money by Aaron Harris video.

Move the Goalposts

A common frustration among pre-seed founders is that they’re constantly being asked to explain their idea concisely. Meanwhile, your vision is likely anything but concise.

“Describe what your company does in 50 characters or less.” - Y Combinator Application

This demand for simplicity is a great segway from the previous section regarding attention span because it’s born out of the same larger theme of limited time. Investors don’t have time to hear about every intricacy of your business (at least not in the first interaction), but it’s easy to feel like you’re skipping over important points when you cut down your information to be more streamlined.

The biggest piece of advice we give to OnePager users about this is to Move the Goalposts. This idiom was originally born out of sports and means to change the criterion (goal) of a process or competition while it is still in progress, in such a way that the new goal offers one side an advantage or disadvantage.

In the context of fundraising - the ultimate goal is to receive funding from the investors you reach out to.

But...

That doesn’t mean that should be the goal of the first set of materials (your OnePager) that you send to investors.

To have investors see your materials for the first time and immediately want to invest is an unrealistic and misleading goal. The real goal is to have these materials lead to a first phone call or meeting. This is a big distinction.

If you’re looking for someone to review your materials and click an “invest now” button without ever talking to you or asking questions, you’re going to have to be pretty thorough in your presentation. Your presentation might end up looking something like this crowdfunding page (it’s a lot to get through):

Linen’s crowdfunding page on Republic: https://republic.co/linen

If you’re looking for someone to review your materials and be interested in jumping on a call to learn more, you can put together your materials knowing that you don’t have to include every little detail or answer every question. This is exactly what OnePager was designed to do and we find ourselves calling it “first date information” when we explain it to founders:

Your OnePager (and the materials within it) should be designed to get you to a productive first phone call or meeting (a first date) where you can not only answer questions, but meet the person who you would potentially be partnering with on this journey.

Low Conversion Rates

Almost every startup that you look up to had a lot of investors say no to them before one of them said yes. There are great examples of this, but one of the best is AirBnB:

“On June 26, 2008, our friend Michael Seibel introduced us to 7 prominent investors in Silicon Valley. We were attempting to raise $150,000 at a $1.5M valuation. That means for $150,000 you could have bought 10% of Airbnb. Below you will see 5 rejections. The other 2 did not reply.” - Brain Chesky, Co-Founder of AirBnB

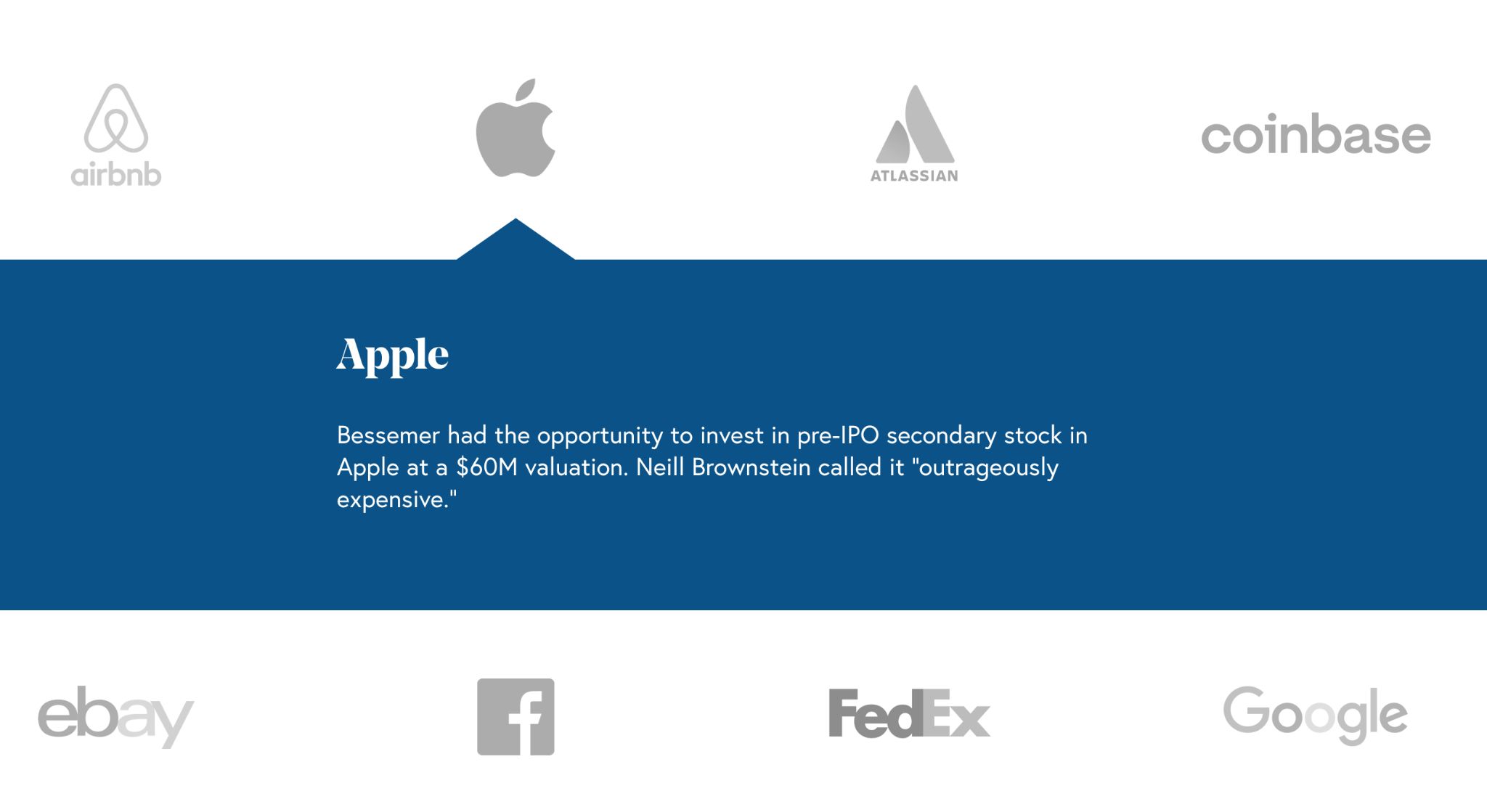

To drive this point home a little further - here’s a snapshot of Bessemer Venture Partners (one of the oldest and best VCs in the world) “anti-portfolio” page where you can see all the companies they passed on:

Check out the full “anti-portfolio” here: https://www.bvp.com/anti-portfolio

So why does this matter to you as a pre-seed founder? You should expect rejections. A lot of them. And make a plan that takes that into consideration.

We often characterize this to founders through the 1% rule: If you’re fundraising, you should only count on 1% of the investors you ask for money to say yes. Your conversion rate might end up being higher (or lower) than that, but it can’t hurt to play it safe when it comes to your startup. With that 1% number in mind you can then make plans that work with it. 1% is not 0%. Mainly, you should plan on talking to at least 100 investors.

Now that we’ve accepted the fact that we’re going to have to talk to at least 100 investors in order to be successful - the fundraising process starts looking a lot more like a sales process and a lot less like an abstract concept. As a sales process, you can now start thinking about your “funnel” and how to make that 1% number work.

For example, if you expect that only 1% of the investors you talk to will say yes and you expect that 10% of the investors you reach out to will be willing to talk to you in the first place - you’re going to have to reach out to 1000 investors.

No one said that it would be easy, but we’ve found that this “sales funnel” way of thinking about fundraising can make the whole process feel more straightforward. Still not easy, but at least it’s not a mystery. It’s also worth noting at this point that Venture Capital is not the only capital option and in a lot of cases isn’t the best fit. If you’re not sure, it’s worth checking out our Fundraising Case Studies post.

If you’re unfamiliar with “funnels” or this type of approach in general, Jack Conte, the founder of Patreon (creator-economy-unicorn) gives an amazing presentation about it in the context of “publishing” that you can check out here: PatreCon: Work to Publish by Jack Conte.

OnePager Was Built For This

We built OnePager to incorporate all of the points discussed above. If you’re a fundraising pre-seed founder or you know a fundraising founder, we’d love for you to check it out. Use the code “Blog100” to get 1 month of OnePager Pro for free.

Recognize limited attention spans

- OnePager is designed to be easy to digest. We “layer” information so that you can include a lot of different assets (descriptions, links, presentations, etc.) in one place without it being overwhelming.

Move the Goalposts

- OnePager is a home for your “first date information” and is meant to get you one step closer to that first phone call. Other tools, like data rooms or crowdfunding pages, are not optimized for the first encounter.

Low conversion rates are standard

- 1000 investors is a lot of investors. When you’re reaching out to that many people it can be hard to be efficient. OnePager was designed to make it easier to do this type of initial outreach and share everything an investor might want to see without emails getting messy with multiple links and different attachments.

Thanks for reading! If you’re looking for more content about fundraising you can check out our blog here.